Gen Y Money To-Dos

If you’re a millennial (born between 1980 and 2000, aka Gen Y), you face financial questions besides just getting through to next payday. Here’s how to seriously plan with your money.

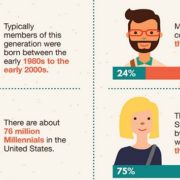

Recent research shows the demographic wave of 75 million American millennials will surpass the number of baby boomers this year, making it the nation’s largest generation.

Millennials are often described as diverse, educated and tech-savvy, with big career goals and an optimistic outlook. When it comes to finances, however, this generation appears averse to risk ? maybe because many of these young professionals came of age during the Great Recession. Some even feel unable to purchase a house or retire until much later in life than their parents, in many cases because of young adults’ staggering student debt.

Last and not least, almost one in four millennials trusts no one for financial advice.

No matter how you refer to this new booming generation ? and it often defies easy description ? its size constitutes a significant force in the economy locally and nationally. With millennials estimated to make up a third to half of the American workforce in just five more years, the time is now for you in Gen Y to understand your financial potential and future.

Plan. Critical for long-term success, your financial action outline doesn’t need to be complicated but rather provide a starting point and create a baseline for measuring your goals.

If like many in your generation you prefer portable, connected devices as personal technology, incorporate programs and apps into your initial planning. For instance, finance sites such as Mint can help you document your money goals, time horizons and investment objectives and, most importantly, create a strategy and action plan.

Your plan can also serve as a basis for an individual or family budget. If you’re unsure where to start, consult a financial professional.

Start investing. With time on your side, invest early on to maximize your returns. Keep investments simple and costs low initially. For instance, consider low-cost, broad-based index funds in your portfolio to diversify holdings, reduce management expenses and mitigate tax consequences.

Automating transfer of money from your paycheck to your investment account streamlines this process. You can start with a small amount of your pay until you get more comfortable, and increase amounts later.

If your company offers a 401(k) plan, see if your employer matches a portion of your contributions. At the very least, contribute enough to receive your full company match, often around 5% of your annual pay (though percentages vary).

With the limit on employee contributions to 401(k)s up to $18,000 in 2015, you stand an even a greater chance to maximize investing for your far-off golden years.

Trim fees. Creating a financial plan includes physically reviewing all incoming revenues and outgoing expenses, the actual (on paper or on screen) paystubs and statements.

You may notice a number of fees tacked onto bills, loans and other expenses that you previously overlooked. Banks, for instance, often quietly change rules and startcharging you increasing amounts for services you once received for free.

Every fee means less money in your pocket. See how many fees you can reduce or remove in the year and reinvest those dollars in a savings or retirement account.

Either can be your best financial friend if you have time on your side.